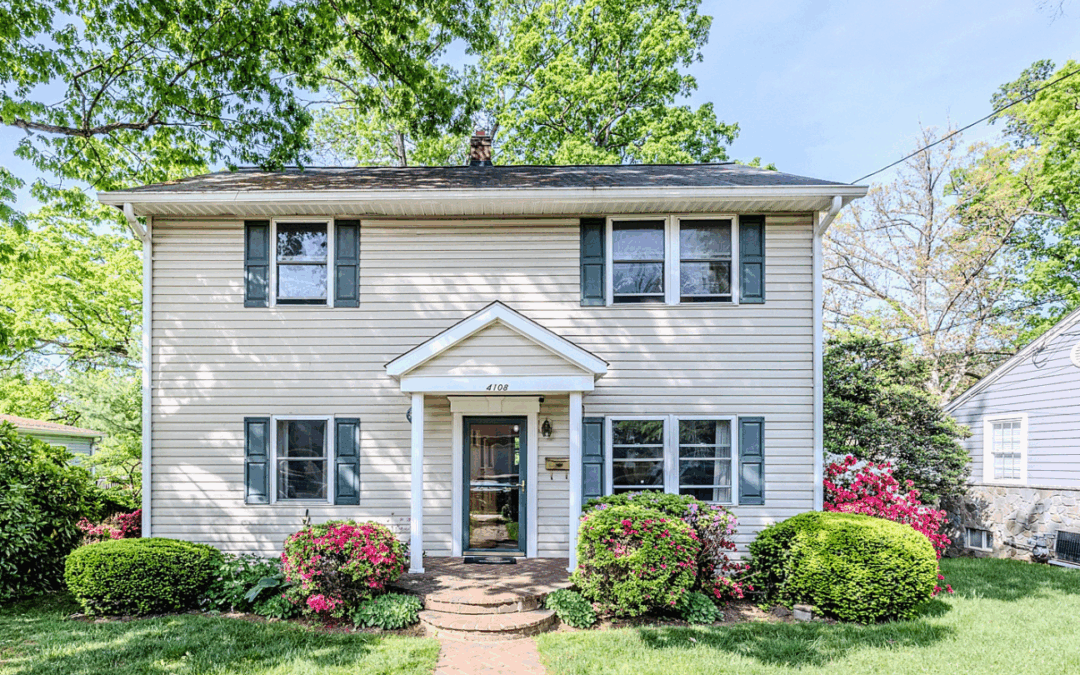

Negotiation Tips for Buyers

For most people, purchasing a home will be one of the largest financial transactions of their lifetime. As such, it’s extremely important home buyers try to get the best deal possible! To help in this endeavor, we’ve put together a list of 10 negotiation tips every buyer should know about, utilizing some statistics from NAR’s 2022 Profile of Home Buyers and Sellers (the latest year available).

Work With an Agent

According to the NAR report, “86% of buyers recently purchased their home through a real estate agent or broker” with (coincidentally) “86% of recent buyers [finding] their real estate agent to be a very or somewhat useful information source.” Not only can agents provide you with crucial information regarding the home buying process, they can also help out significantly when it comes to negotiating price and terms.

As such, if you’re planning on entering the market, getting with a licensed professional as soon as possible is a great first step toward purchasing your dream home – and for a good price at that!

Get Your Finances in Order

Because buying a home is such a huge financial undertaking, most home buyers seek out a mortgage loan in order to make the purchase. The stats back it up too with “78% of recent buyers [financing] their home purchase.” Lenders don’t just hand out money to anyone though, so it’s important to start getting your finances in order as soon as you begin thinking you want to purchase a home.

This includes taking a look at your credit score, income, debts, savings, assets, and potential down payment amount, so you can see where you stand and where you might need to improve? Do you need to raise your credit score? Ensure you’re making payments to financial institutions on time. Need to knock down your debt before taking on any more? Start making small, regular payments on balances each week to slowly chip away at it. Need to start saving toward a down payment? Set aside a percentage of each paycheck toward your goal, or consider cutting back in your budget where you can. According to the report, “the typical [down payment] for first-time buyers was 6% while the typical [down payment’ for repeat buyers was 17%.”

Along with getting in contact with an agent, getting your finances in order should be one of your first steps in the process as both are critical when it comes negotiating time.

Get Preapproved

After seriously scrutinizing your finances and making any necessary adjustments or improvements, you’ll be in a much better position to get a letter of preapproval from a lender! Getting preapproved is one of the best things you can do to help out come negotiation time. A letter of preapproval lets sellers know you’re a serious and qualified buyer. It also lets them know you’re in a better position to move quickly should they need or want to do so, giving you more negotiation power than you’d have without preapproval.

Getting preapproved is its own process within a process though, so it’s important to know the ins and outs before diving in head first. A good agent will also be able to help guide you through the process.

Know Your Market

Before entering your local market, it’s important to know the market climate. Is the market hot with properties receiving multiple offers as soon as they hit the market? If that’s the case, you’ll have less room when it comes to negotiating price and terms. Now, is your local market more stagnant with homes receiving less offers? In this situation, you’ll have much more negotiating power.

It’s important to know what to expect realistically – good or bad. An experienced, knowledgeable agent will have this insight and prepare home buyers accordingly.

Include Important Contingencies

Depending on your local market climate, you may or may not have much negotiating power come closing time. If you do have a bit of an upper hand, it’s smart to include some contingencies in your contract.

For those who have never purchased a home before or simply need a refresher, contingencies are clauses added into a purchase agreement that allow you to back out of the sale if certain criteria are not met. Simply put, the sale of the home is contingent upon these specified conditions.

Some common contingencies include inspection, appraisal, title contingencies. While certain markets truly won’t allow room for contingencies, it’s important to at least try to include these common contingencies. Inspections can unearth significant, systemic problems in a home that would otherwise remain hidden without an inspection contingency, and with “88% of buyers [purchasing a previously-owned home,” inspections should be top of mind for buyers. Appraisal contingencies ensure you aren’t paying more than the home’s true value. Additionally, most lenders require an appraisal before offering final approval on a loan. Lastly, title contingencies certify there are no financial obligations or disputes concerning the property and that the seller has the legal right to transfer ownership of the property. Without a title contingency, you run the risk of uncovering significant issues once it’s too late.

As such, it’s important to utilize whatever negotiating power you have to include common contingencies to your purchase agreement.

Ask for Seller Concessions

Along with contingencies come concessions. Concessions are closing costs the seller has agreed to pay. These closing costs can include pre-paid property taxes, title insurance, loan fees, inspection fees, appraisal fees, attorney fees, and more. Like with contingencies, the addition of concessions may be contingent upon the state of the market, so you may not always be able to negotiate these concessions. If you are in a position to do so, it’s strongly recommended that you do as these costs can add up, ranging anywhere from 3-6% of the purchase price.

Get Personal

When negotiating price and terms, it’s a good idea to figure out why the homeowner is selling. For example, if your seller is recently divorced, they may be more eager to sell, allowing you a bit more negotiation power. On the other hand, perhaps your seller simply wishes to move closer to family and friends, which is “the most commonly cited reason for selling [a] home” at 21%, so they may not be in as quick of a rush. Knowing the why can help you (or rather your agent) to be more effective at the negotiation table.

Another way to get personal is to include a letter with your offer, letting the homeowner know the care you plan to put into the home as well as the memories you hope to build there. Selling a home can be a very emotional undertaking for many sellers, so to know that the home will be in good hands is important in the decision making process. Writing a personal letter will help you stand out from other offers, giving you an edge in more competitive markets.

Expect to Compromise

While you ideally want the best price and terms possible, it’s important to understand that a negotiation is a compromise; there’s a good chance you may not get everything you want, so going into the home buying process with realistic expectations is crucial. A good agent will help you to know when it’s time to compromise and when it’s time to walk away.

The Bottom Line

Negotiating the purchase of a home can be extremely intimidating and overwhelming, especially for a first time home buyer. Utilizing these tips will make securing your dream home more likely – and with less stress along the way.

If you’re looking to purchase a home in the DMV, please don’t hesitate to reach out to us. We have a team of agents experienced in negotiating real estate transactions and offer free, no strings attached consultations.