Is It Better to Rent or Buy?

Is it better to rent or buy? It’s a question many Americans across the Nation face at some point in their lives; one you may yourself may be considering right now.

To be upfront, you should know there’s no quick “yes” or “no” answer to this question. The real answer is: “it depends.” It depends on a number of factors including your financial situation, future plans and goals, the status of the market in your area, and your overall mentality. To help you in deciding what’s best for you, we’ll go over some questions you should ask yourself when assessing each area as well as some pros and cons of renting vs. buying.

How is Your Financial Situation?

When renting a home or apartment, you’re only paying the rent, renter’s insurance, and utilities. However, when it comes to buying a home, there are more costs to consider. Yes, you’ll have a monthly mortgage payment along with utilities, but you’ll also have home insurance, which is typically more than renter’s insurance, taxes, closing costs, and maintenance on the home.

Additionally, if you’re considering buying a home, you’ll need to think about your financial situation as it relates to actually buying the home. Meaning, how is your credit score? Do you have a stable, sufficient income? Do you have any outstanding debts? How does your savings look? Do you have enough for a down payment? Will you have any emergency savings after this? Remember, you’ll want to put down at least 20%.

Of course, we’re not trying to steer you away from buying a home; we just want you to be aware of all the costs you’ll encounter when you own a home!

Where Do You See Yourself in the Next Few Years?

If you’re planning on staying put for at least 3 years, it definitely makes more sense to go ahead and buy rather than continue renting. When you purchase a home, there are closing costs associated with the purchase. Typically, you’re allowed to spread those costs out over a few years. However, if you leave your home before 3 years, it just doesn’t make sense financially. You’ll be bombarded with all these costs with nothing to show for it.

So, if you’re planning to stay put for at least 3 years and are in a good place financially and mentally, go ahead and buy! Additionally, if it’s a long term goal of yours to own a home, it makes even more sense to pull the trigger!

How is the Market in Your Area?

If you’re considering buying a home, it’s important to know what the real estate market looks like in your area. Are home values in your area appreciating or depreciating? Buying a home, unlike renting, is an investment, so you want to make sure that if you do decide to sell at some point down the line, that you’ll get back what you paid (and then some, ideally).

You’ll also want to look at what’s happening with rents in your area. Nationally, rents are skyrocketing, so if this is true in your area, it gives you even more incentive to buy rather than continue renting.

Where are You at Mentally?

Owning a home is not only one of the largest purchases most Americans will make in their lifetime, it’s also a huge responsibility, so you want to be sure that you’re in good headspace when going into the buy and that you’re ready to take on a responsibility of this magnitude. Also, ask yourself why you want to own a home. Is it because you feel pressured to do so or because it’s a real goal of yours? Knowing why you’re doing what you’re doing will help when things get difficult.

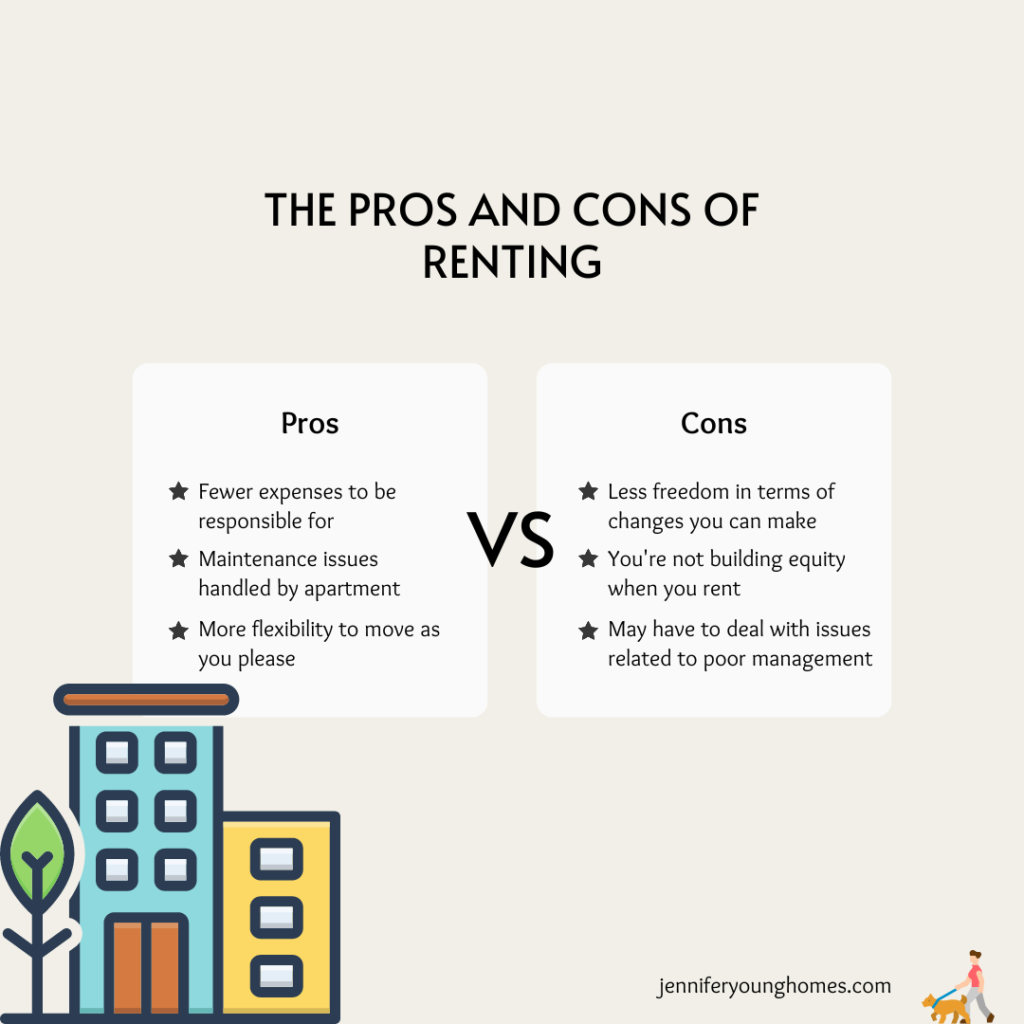

What are the Pros and Cons of Renting?

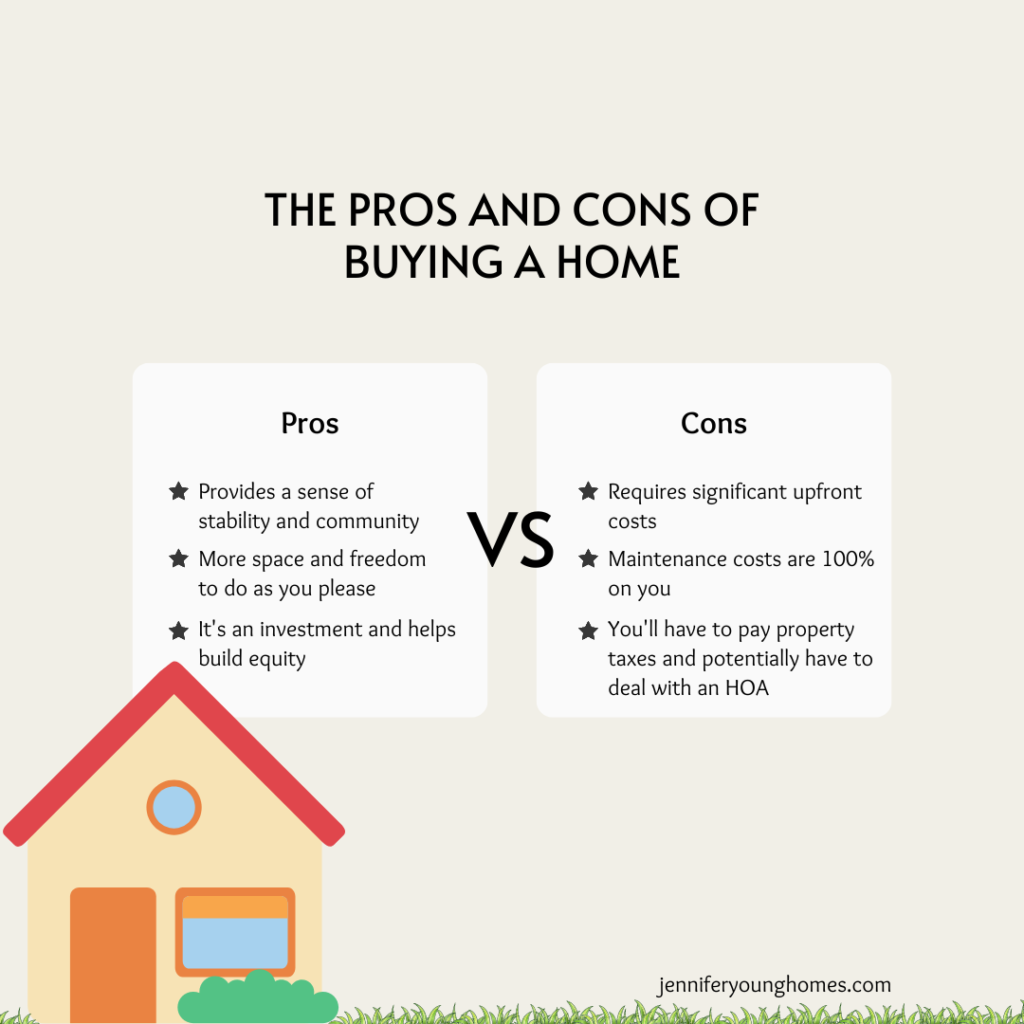

What Are the Pros and Cons of Buying?

What Does This Mean for You?

After assessing each area, you’ll have a better idea if you should buy or continue renting. Again, the right answer is whatever is right for you! If you have any lingering questions on renting vs. buying, please reach out! We offer free consultations with absolutely no strings attached.